Ayushman Bharat Yojana, also known as the Pradhan Mantri Jan Arogya Yojana (PMJAY), is a scheme that aims to help economically vulnerable Indians who are in need of healthcare facilities.

PM-JAY.

Ayushman Bharat Yojana – National Health Protection Scheme, which has now been renamed as Pradhan Mantri Jan Arogya Yojana, plans to make secondary and tertiary healthcare completely cashless. The PM Jan Arogya Yojana beneficiaries get an e-card that can be used to avail services at an empanelled hospital, public or private, anywhere in the country. With it, you can walk into a hospital and obtain cashless treatment.

The coverage includes 3 days of pre-hospitalisation and 15 days of post-hospitalisation expenses. Moreover, around 1,400 procedures with all related costs like OT expenses are taken care of. All in all, PMJAY and the e-card provide a coverage of Rs. 5 lakh per family, per year, thus helping the economically disadvantaged obtain easy access to healthcare services.

PMJAY Health Cover Categories: Eligibility Criteria for Rural & Urban People

The PMJAY scheme aims to provide healthcare to 10 crore families, who are mostly poor and have lower middle income, through a health insurance scheme providing a cover of Rs. 5 lakh per family. The 10 crore families comprise 8 crore families in rural areas and 2.33 crore families in urban areas. Broken into smaller units, this means the scheme will aim to cater to 50 crore individual beneficiaries.

However, the scheme has certain pre-conditions by which it picks who can avail of the health cover benefit. While in the rural areas the list is mostly categorized on lack of housing, meagre income and other deprivations, the urban list of PMJAY beneficiaries is drawn up on the basis of occupation.

Love Clean Tool-(files clean &app boost&cpu cool)? Free try it now.

PMJAY Rural:

The 71st round of the National Sample Survey Organisation reveals that a staggering 85.9% of rural households do not have access to any healthcare insurance or assurance. Additionally, 24% of rural families access healthcare facilities by borrowing money. PMJAY’s aim is to help this sector avoid debt traps and avail services by providing yearly assistance of up to Rs. 5 lakh per family. The scheme will come to the aid of economically disadvantaged families as per data in the Socio-Economic Caste Census 2011. Here too, households enrolled under the Rashtriya Swasthya Bima Yojana (RSBY) will come under the ambit of the PM Jan Arogya Yojana.

In the rural areas, the PMJAY health cover is available to:

1) Those living in scheduled caste and scheduled tribe households

2) Families with no male member aged 16 to 59 years

3) Beggars and those surviving on alms

4) Families with no individuals aged between 16 and 59 years

5) Families having at least one physically challenged member and no able-bodied adult member

6) Landless households who make a living by working as casual manual labourers

7) Primitive tribal communities

8) Legally released bonded labourers

9) Families living in one-room makeshift houses with no proper walls or roof

10) Manual scavenger families

PMJAY Urban:

According to the National Sample Survey Organisation (71st round), 82% of urban households do not have access to healthcare insurance or assurance. Further, 18% of Indians in urban areas have addressed healthcare expenses by borrowing money in one form or the other. Pradhan Mantri Jan Arogya Yojana helps these households avail healthcare services by providing funding of up to Rs. 5 lakh per family, per year. PMJAY will benefit urban workers’ families in the occupational category present as per the Socio-Economic Caste Census 2011. Further, any family enrolled under the Rashtriya Swasthaya Bima Yojana will benefit from the PM Jan Arogya Yojana as well.

In the urban areas, those who can avail of the government-sponsored scheme consist mainly of:

1. Washerman / chowkidars

2. Rag pickers

3. Mechanics, electricians, repair workers

4. Domestic help

5. Sanitation workers, gardeners, sweepers

6. Home-based artisans or handicraft workers, tailors

7. Cobblers, hawkers and others providing services by working on streets or pavements

8. Plumbers, masons, construction workers, porters, welders, painters and security guards

9. Transport workers like drivers, conductors, helpers, cart or rickshaw pullers

10. Assistants, peons in small establishments, delivery boys, shopkeepers and waiters

People not entitled for the Health Cover under Pradhan Mantri Jan Arogya Yojana:

1. Those who own a two, three or four-wheeler or a motorised fishing boat

2. Those who own mechanised farming equipment

3. Those who have Kisan cards with a credit limit of Rs.50000

4. Those employed by the government

5. Those who work in government-managed non-agricultural enterprises hu

6. Those earning a monthly income above Rs.10000

7. Those owning refrigerators and landlines

8. Those with decent, solidly built houses

9. Those owning 5 acres or more of agricultural land

You May Also Like : 10 Benefits Of The PMJAY Ayushman Bharat Yojana That Every Indian Should Know

Medical Packages and Hospitalization Process in Ayushman Bharat Scheme (PMJAY)

The Rs. 5 lakh insurance cover provided by the Pradhan Mantri Jan Arogya scheme can be utilized not just by individuals in particular, but also by families in general. This lumpsum is enough to cover both the medical and surgical treatments in 25 specialities among which are cardiology, neurosurgery, oncology, paediatrics, orthopaedics, etc. However, medical and surgical expenses cannot be reimbursed simultaneously.

If multiple surgeries are necessary, the highest package cost is paid for in the first instance followed by a 50% waiver for the second and a 25% discount for the third. Unlike other health insurance schemes, there is no waiting period for pre-existing diseases under PMJAY scheme, which comes under the larger umbrella scheme of Ayushman Bharat Yojana. Should any beneficiary or anyone in their family require hospitalization, they need not pay anything, provided they are admitted in any empanelled government or private hospital.

The cashless treatment and hospitalization is made possible due to a 60:40 cost sharing agreement between the Centre and states. Once identified as a genuine beneficiary, you or your family member will be issued a health card by specially trained Ayushman Mitras, who man kiosks in hospitals for those unaware of the PMJAY scheme.

With these details in hand, you can benefit from the features of the Pradhan Mantri Jan Awas Yojana or help someone else get the healthcare cover benefit.

PMJAY Illness Coverage: List of Critical Diseases covered under PM Jan Arogya Yojana

PMJAY helps households access secondary and tertiary care via funding of up to Rs. 5 lakh per family, per year. This assistance is valid for day care procedures and even applies to pre-existing conditions. PMJAY extends coverage for over 1,350 medical packages at empanelled public and private hospitals.

Some of the Critical illnesses that are covered are as follows.

Prostate cancer

Coronary artery bypass grafting

Double valve replacement

Carotid angioplasty with stent

Pulmonary valve replacement

Skull base surgery

Laryngopharyngectomy with gastric pull-up

Anterior spine fixation

Tissue expander for disfigurement following burns

PMJAY has a minimal list of exclusions. They are as follows.

- OPD

- Drug rehabilitation programme

- Cosmetic related procedures

- Fertility related procedures

- Organ transplants

- Individual diagnostics (for evaluation)

Advantages of Health Insurance in India

The main advantage of having a health insurance policy is that you can avail medical treatment without suffering any strain on your finances. Moreover, as a significant number of Indians end up borrowing money informally to pay medical bills, utilising the features of PMJAY helps avoid the risk of a debt trap. You can get upto Rs. 5 lakh treatment under PMJAY but you can also buy health insurance from Bajaj Finserv to avail more coverage & benefits for yourself and your family.

Alternately, you can explore other health policies too like Pocket Insurance by Bajaj Finserv which offers affordable policies to take care of your specific needs. What’s more, you can apply for these policies easily online. For instance, Dengue Cover helps you pay for diagnostic tests in case you contract malaria or dengue, while Hospital Cash Cover gives you daily cash assistance of up to Rs.1,000 per day that you can use for a range of expenses. You can also purchase plans such as Adventure Cover if you get injured or Kidney Stones Cover in case you suffer from this condition. Regardless of the policy you choose, you can get substantial coverage at a nominal premium and protect every aspect of your health in an instant

Alternatively, to know if you are eligible for PMJAY you can approach any Empanelled Health Care Provider (EHCP) or dial the Ayushman Bharat Yojana call centre number: 14555 or 1800-111-565

Ayushman Bharat Yojana: PMJAY Patient Card Generation

Once you are eligible for the PMJAY benefits, you can work towards getting an e-card. Before this card is issued, your identity is verified at a PMJAY kiosk with the help of a document like your Aadhaar card or ration card. Family identification proofs that can be produced include a government certified list of members, PM letter and an RSBY card. Once the verification is completed, the e-card is printed along with the unique AB-PMJAY ID. You can use this as proof at any point in the future

Imortant Link For Check Ayushman Bharat Yojana Beneficiaries List 2022

Click here to visit the website

How to check your name

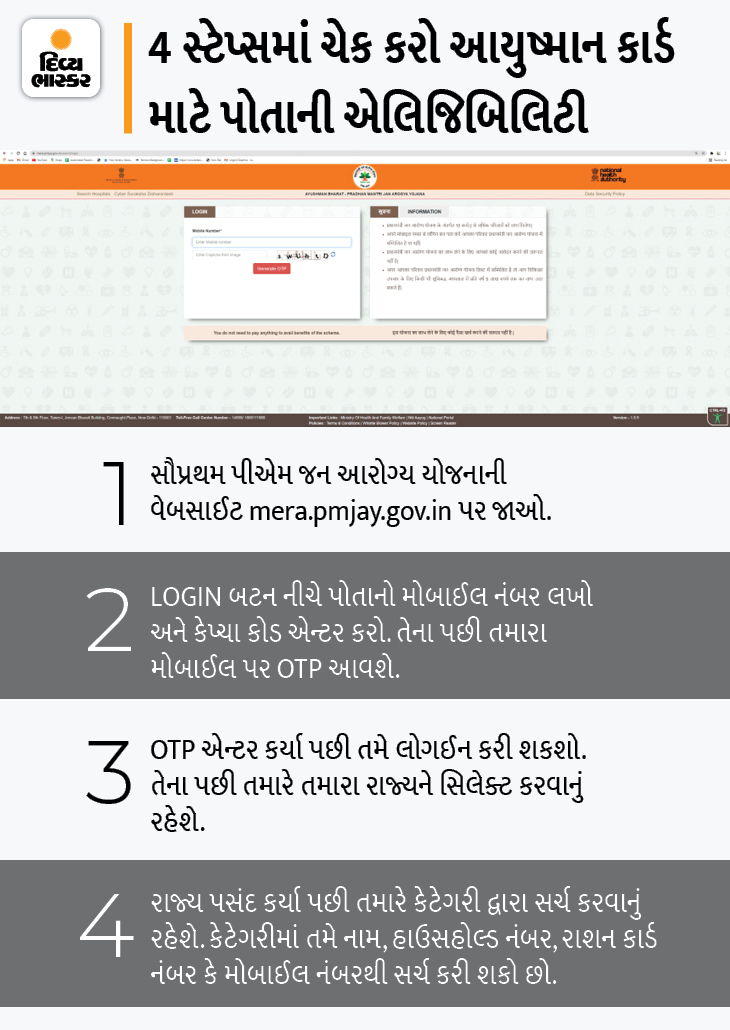

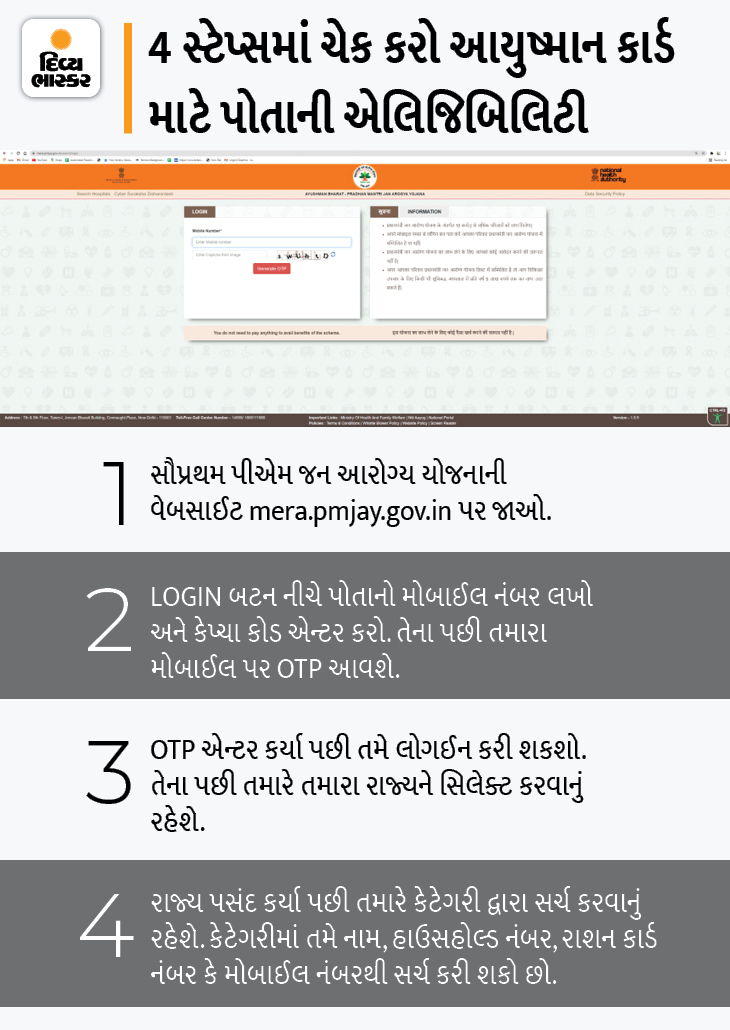

You can check online whether your name is in PMJAY scheme or not. For this you have to open the website of mera.pmjay.gov.in.

CLICK HERE TO CHECK NAME.

After opening the website, enter your mobile number and the security code provided in the box provided there. Then click on Generate OTP button so that an OTP will come on your mobile. Input this OTP on the website and click on Submit button.

If this plan has your name, after a while information like your name, address will come on the right side and also SMS will come to the mobile number you have entered.

If this plan has your name, after a while information like your name, address will come on the right side and also SMS will come to the mobile number you have entered.

How to get benefit?

Beneficiary does not need any special card for PMJAY scheme. Beneficiaries will have a "Lifetime Help Desk" in every government as well as private hospital associated with the scheme to establish their identity only. Where the beneficiary has to prove his eligibility by giving documents. Once the eligibility is proved, the beneficiary does not have to spend a single rupee for treatment up to Rs 5 lakh.

Currently PMJAY scheme is not applicable in Delhi, West Bengal, Orissa, Kerala, Telangana and Punjab! Because some of those states have a similar scheme in place, and some states want such a scheme of their own.

Major Diseases and Surgeries covered in Ayushman Bharat Yojana Every poor citizen of the country will get the benefit of major diseases and major operations as well as hospital procedures free of cost under Ayushman Bharat

If this plan has your name, after a while information like your name, address will come on the right side and also SMS will come to the mobile number you have entered.

If this plan has your name, after a while information like your name, address will come on the right side and also SMS will come to the mobile number you have entered.

Isme adhar card se loan ki koi information nahi hai, sirf ayushyman card ki details hai... Chutiya banane ka dhandha bandh kijiye...

ReplyDelete